The Future You’ve Been Waiting for Arrives August 26!

FutureMarksm—Legacy’s newest fixed indexed annuity innovation from “A” rated* Americo Financial Life and Annuity Insurance Company launches Monday, August 26, 2019, helping clients accumulate more so they can leave more to loved ones.

If you missed today’s exclusive webinar, watch our replay and discover:

- Unique pre-blended strategies that simplify diversification and lock in rates for five years.

- A no-cost enhanced death benefit rider with no underwriting or waiting period.

- Exceptional 8% street-level commission** through age 75.

Get ready to start selling FutureMarksm August 26!

- If you aren’t already, get contracted with Americo before writing business.

- Take your FutureMarksm product training before soliciting new business.

For more information, call the Legacy Sales Team at 800-395-1053, Ext. 4002.

FutureMarksm 10, 10 LT (Contract Series 416/4416). BeneBoostersm guaranteed minimum death benefit rider (Rider Series 2182). Products are single premium deferred fixed indexed annuities underwritten by Americo Financial Life and Annuity Insurance Company (Americo), Kansas City, MO, and may vary in accordance with state laws. Products are designed and exclusively marketed by Legacy Marketing Group®, an independent, authorized agency of Americo. Some products and benefits may not be available in all states. Certain restrictions and variations apply. Consult contract and riders for all limitations and exclusions. The Optimizer administrative fee of 1.00% will be deducted from the Accumulation Value at the end of each contract year, including the first.

| * | Rating for Americo Financial Life and Annuity Insurance Company (Americo), September 2018. Americo Financial Life and Annuity Insurance Company has a financial strength rating of A (Excellent, 3rd out of 15 rating categories). A.M. Best’s rating is assigned after a comprehensive quantitative and qualitative evaluation of a company’s balance sheet strength, operating performance, and business profile. A.M. Best uses a scale of 15 ratings, ranging from “A++” to “F.” |

| ** | GA level. See Compensation Schedule for details. |

| LMG4177v0819 18-625-9 (08/19) |

FOR AGENT USE ONLY. NOT FOR USE WITH CONSUMERS. |

A Five-Year Strategy for Older Clients?

|

I love the opportunity of annual crediting PLUS multi-year upside in a single strategy! But I have older clients who are looking to leave a legacy. With the FUSION Strategysm, what happens if my older client dies during the five-year term? |

|

The FUSION Strategysm* locks in credited amounts on gain at the end of each of the first four years, so previously credited earnings will always be part of the death benefit. Plus, with the Americo Financial Life and Annuity Insurance Company suite of fixed indexed annuities, index gains always vest at death. On the FUSION Strategysm, this means that upon receipt of proof of death requirements, the participation rate will credit on index increases that have occurred since the beginning of the strategy period. Clients can rest assured knowing their beneficiaries will be taken care of. With two ways to earn, the FUSION Strategysm is a smart choice for older clients looking to leave a legacy to their loved ones. And it’s available on LibertyMarksm 10-year products through age 85, and on ClassicMark® through age 90! Action required! To sell ClassicMark® or LibertyMarksm 10-year products with the FUSION Strategysm, make sure to take—or retake—the product training to avoid re-solicitation requirements. |

ClassicMark® 10, 10 LT (Contract Series 411/4190/4204); ClassicMark® 10 Plus, 10 LT Plus (Contract Series 411/4179/4190/4204); LibertyMarksm 10, 10 LT, SE 10, SE 10 LT (Contract Series 411/4196/4205); LibertyMarksm 10 Plus, 10 LT Plus, SE 10 Plus, SE 10 LT Plus (Contract Series 411/4179/4196/4205). Products are single premium deferred fixed indexed annuities underwritten by Americo Financial Life and Annuity Insurance Company (Americo), Kansas City, MO, and may vary in accordance with state laws. Products are designed and exclusively marketed by Legacy Marketing Group®, an independent, authorized agency of Americo. Some products and benefits may not be available in all states. Certain restrictions and variations apply. Consult contract and riders for all limitations and exclusions. On LibertyMarksm, the Liberty Optimizer administrative fee of 1.25–1.75% (depending on the product version selected) will be deducted from the Accumulation Value at the end of each contract year, including the first.

The SG Columbia Adaptive Risk Allocation Index (“Index”) is the exclusive property of SG Americas Securities, LLC (together with its affiliates, “SG”). SG has contracted with Solactive AG to maintain and calculate the Index. “SG Americas Securities, LLC”, “SGAS”, “Société Générale”, “SG”, “SG Columbia Adaptive Risk Allocation Index”, et al. (collectively, the “SG Marks”) are trademarks or service marks of SG. SG has licensed use of the Index and the SG Marks to Americo Financial Life and Annuity Insurance Company (“Americo”) for use in fixed indexed annuities. SG has licensed use of certain marks from Columbia Management Investment Advisers, LLC or its affiliates (collectively, “Columbia Management”) and sub-licensed use to Americo. Neither SG, Solactive AG, Columbia Management nor any other third-party licensor has been authorized to act as an agent of Americo or has in any way sponsored, endorsed, sold, promoted, structured or priced any fixed indexed annuity or provided investment advice to Americo. Such parties make no representation regarding the advisability of purchasing, selling, or holding product linked to the Index, including Fixed Indexed Annuity and shall not be liable for any related loss or payment thereof. Obligations to make payments under the fixed indexed annuities are solely the obligation of Americo. Neither Americo nor SG are obligated to invest annuity payments in the components of the Index. The Index levels are net of a 0.50% annual maintenance fee, which may be as high as 0.75% due to the potential leverage of up to 150% in the Index, calculated and deducted daily. The Index also deducts fees to cover rebalancing, replication, and other costs. The total amount of these fees is unpredictable and depends on a number of factors. These fees and costs will reduce the potential positive change in the Index and increase the potential negative change in the Index. While the volatility control applied by the Index may result in less fluctuation in rates of return as compared to indices without volatility controls, it may also reduce the overall rate of return as compared to products not subject to volatility controls. Columbia Threadneedle Investments is the global brand name of the Columbia and Threadneedle group of companies. Additional information is available at www.sg-columbia-index.com.

| * | The FUSION Strategysm is also known as the SG Columbia Adaptive Risk Allocation Index Point-to-Point (Without Cap) With Amount on Gain. |

| LMG4177v0819 18-625-9 (08/19) |

FOR AGENT USE ONLY. NOT FOR USE WITH CONSUMERS. |

Retirees Could Lose $3.4 Trillion Due to Poor Timing

Could your clients use a 9% retirement income raise? According to a recent study published by United Income,* the average retiree would receive 9% greater income in retirement if they claimed Social Security at the financially optimal time. In fact, retirees will lose a collective $3.4 trillion in potential income because they claim Social Security at a financially suboptimal time. That equates to an average of $111,000 per household!

By waiting to elect Social Security until they can receive maximum benefits, clients may experience an income gap early in retirement, but most will be wealthier in their late 70s and beyond. The fear of near-term shortage is what makes it difficult for many clients to wait to elect Social Security benefits.

Imagine telling your clients that you know how to increase their retirement nest egg by $111,000 on average by simply helping them elect Social Security at the optimal time! With the lifestyle payout option, available with the FlexMark Selectsm MyFit income riders** from Ameritas Life Insurance Corp., clients can receive increased payments for an initial period, filling the early retirement income gap and allowing them to maximize Social Security.

Watch the “Power of Lifestyle” mini-webinar to learn more about the lifestyle payout option, or call the Legacy Sales Team at 800-395-1053, Ext. 4002.

In approved states, FlexMark Selectsm Index Annuities (Form 2705) and riders are issued by Ameritas Life Insurance Corp. (Ameritas) located at 5900 O Street, Lincoln, NE 68510. Products are designed in conjunction with Ameritas and exclusively marketed by Legacy Marketing Group®. Ameritas and Legacy Marketing Group® are separate, independent entities. FlexMark Selectsm Index Annuities are single premium deferred annuities that offer a fixed interest option and index interest options. The index options are not securities. Keep in mind, your clients are not participating in the market or investing in any stock or bond. Policies, index strategies, and riders may vary and may not be available in all states. Optional features and riders may have limitations, restrictions, and additional charges. Product guarantees are based on the claims-paying ability of Ameritas Life Insurance Corp. Refer to brochures for additional details. FlexMark Selectsm and MyFit Income Ridersm are service marks of Legacy Marketing Group®.

Information gathered from external sources is believed to be reliable; however, we make no representations as to its completeness or accuracy. All economic and performance information is historical and is not indicative of nor does it guarantee future results. This information should not be construed as investment, legal, or tax advice. Unless otherwise specified, any person or entity referenced herein is not an affiliate of Ameritas or any of its affiliates.

| * | Matt Fellowes, Jason J. Fichtner, Lincoln Plews, and Kevin Whitman, “The Retirement Solution Hiding in Plain Sight”, UnitedIncome.com (June 28, 2019). |

| ** | Income rider not available with certain tax-qualified plan types. Available for a current annual charge of 0.95% for the MyFit Income Ridersm and 1.05% for the MyFit Income Ridersm With Booster (not available in all states). |

| LMG4177v0819 | FOR AGENT USE ONLY. NOT FOR USE WITH CONSUMERS. |

Updated Americo Program Means Fewer Suitability Calls to Clients

The number of suitability calls Americo Financial Life and Annuity Insurance Company conducts with applicants ages 85 and younger will decrease under the carrier’s updated suitability program. Instead of receiving calls, a select number of applicants each month will get a letter from Americo outlining certain policy provisions such as the contract’s penalty-free withdrawal benefit, surrender charges, and applicable fees or charges. Copies of the letters will be made available to Producers.

Regardless of whether your clients are called or receive a letter, make sure to provide Americo with a current phone number for your clients and to let your clients know Americo may be contacting them, either by phone or mail, about their annuity purchase.

If you have any questions, please call Legacy’s Suitability Help Desk at 800-395-1053, Ext. 5819.

Simplified Legacy Producer/IMO Transfer Form Available 9/1

A new, one-page, transfer form for Legacy Producer and IMO transfers will be available in The Forms Store under Licensing & Contracting starting September 1, 2019, as part of the Legacy Transfer Packet. The updated Legacy Producer/IMO Transfer Request Form, LMG4228v0919, should be used with all Legacy transfers (new Legacy contracting paperwork should not be used for transfers unless the agent is currently an LOA). To check a current Legacy Producer’s transfer eligibility, IMOs can visit the Recruiting Center. For more information, please review the Legacy Transfer Policy, LMG1160v0919, or call the Licensing and Contracting Team at 800-395-1053, Ext. 4007.

Five Fun Facts

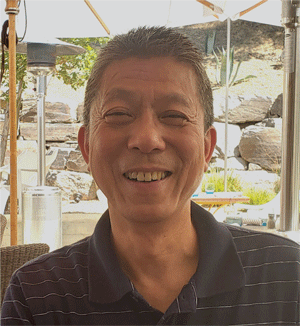

Larry Yee,

Senior Business Systems Analyst

- A Hong Kong native, Larry has lived in the States since age three. He spent his early childhood on the East Coast and moved to Sacramento during grade school. After graduating from UC Berkeley, Larry worked in San Francisco before moving to Petaluma in 1996—where he has been ever since.

- All in all, Larry has been at Legacy 15 years—as a Business Systems Analyst from 1998 through 2009, and as master of all trades on the IT team since 2015. He supports Legacy in many efforts: business analysis, network and server support, tech support, testing and implementing projects, and more. Larry appreciates helping his customers, both internal and external, and enjoys implementing systems and processes to support teams in doing their jobs even more efficiently and effectively.

- Before coming to Legacy, Larry opened his own business as a trading card distributor. He started out trading his comic books for baseball cards, and ended up trading for all major trading card companies.

- While working in SF for an insurance company, Larry met his now wife, Susan, who later joined the Legacy family, where she works on the Commissions team. They enjoy working in the same building every day. Speaking of family, Larry and Susan’s daughter Lauren spent some time at Legacy, too, on the Compliance team.

- Larry enjoys living in Petaluma and doesn’t plan to leave. In fact, when asked about his travels, Larry says he and his wife don’t do a whole lot outside of the area, but instead enjoy exploring their own backyard.

Labor Day

In observance of Labor Day, Legacy and our carriers will be closed Monday, September 2. We will reopen Tuesday, September 3.