As the market continues to seesaw, fixed indexed annuities, with their underlying minimum guarantees, growth potential, and lifetime income options are more attractive than ever to consumers who want to preserve and grow their wealth. And recent enhancements to our FIAs give you more opportunities than ever to feel good about helping clients protect and grow their retirement.

Case in point: the recent 60% increase in the minimum guarantee for ClassicMark® and LibertyMarksm Series FIAs. One of the strongest minimum guarantees in the industry, the new 1.60% on 100% of premium minimum guarantee* means clients would receive 17.20% after 10 years in a worst-case scenario. ClassicMark® and LibertyMarksm don’t stop with strong guaranteed rates. Their powerful benefits also include:

- The upside potential of five no-cap participation rate strategies—which help clients capitalize on the market’s upside.

- The strength and security of “A” rated Americo Financial Life and Annuity Insurance Company.**

For sales ideas and more information, call the Legacy Sales Team at 800-395-1053, Ext. 4002.

ClassicMark® 10, 10 LT (Contract Series 411/411LG10/411LG86+/4190/4204); ClassicMark® 10 Plus, 10 LT Plus (Contract Series 411/411LG10+/4179/4190/4204); LibertyMarksm 7, 10, 10 LT, SE 7, SE 10, SE 10 LT (Contract Series 411/4196/4205); LibertyMarksm 7 Plus, SE 7 Plus (Contract Series 411/4191/4196/4205); and LibertyMarksm 10 Plus, 10 LT Plus, SE 10 Plus, SE 10 LT Plus (Contract Series 411/4179/4184/4196/4205) single premium deferred fixed indexed annuities are underwritten by Americo Financial Life and Annuity Insurance Company (Americo), Kansas City, MO, and may vary in accordance with state laws. Products are designed and exclusively marketed by Legacy Marketing Group®. On LibertyMarksm and LibertyMarksm SE products, the Liberty Optimizer administrative fee of 1.00–1.75% (depending on the product version selected) will be deducted from the Accumulation Value at the end of each contract year, including the first. Legacy Marketing Group® is an independent, authorized agency of Americo.

| * | Available upon death, surrender, or annuitization, less surrender charges. Rate on contracts issued in 2019. |

| ** | Rating for Americo Financial Life and Annuity Insurance Company (Americo), July 2017. Americo Financial Life and Annuity Insurance Company has a financial strength rating of A (Excellent, 3rd out of 15 rating categories). A.M. Best’s rating is assigned after a comprehensive quantitative and qualitative evaluation of a company’s balance sheet strength, operating performance, and business profile. A.M. Best uses a scale of 15 ratings, ranging from “A++” to “F.” |

|

An Open Letter to Preston and Lynda Pitts

Preston and Lynda,

As you know, I have been an expert in the indexed annuity market for 20 years now. One of the first habits I took up when I entered the field of product development was reading and analyzing specimen contracts on these products. In fact, I have read every specimen contract for every indexed annuity that has been available over the past 14 years (and some that never launched)! Now you can understand why I am the life of the party, right?

As different market forces have occurred (e.g., low interest rates, market volatility, etc.), product development has responded and evolved. For example, I’ve witnessed the following changes as a result of the decade-long period of historically low interest rates we’ve experienced:

- Shifting premium bonuses from the account value of the contract to the benefit base of the rider.

- Reducing minimum guaranteed surrender values from being based on 100% or 90% of premiums to being based on the statutory minimum of 87.50%.

- Reducing the penalty-free withdrawal amount from 10% to 7%, or even 5%.

- Increasing minimum initial premiums from $5,000 (NQ) / $2,000 (Q) to $25,000, $50,000, or even $100,000.

- Using participation rates and spreads to limit indexed interest, rather than caps.

- Using indices outside of the S&P 500® for indexed interest.

- Shifting Guaranteed Lifetime Withdrawal Benefit (GLWB) rider charges to be based on the benefit base value of the rider, as opposed to the account value of the annuity.

- Shifting GLWB roll-ups from compound interest to simple interest.

- Rider charges that not only invade the principal of the contract, but often the minimum guaranteed surrender value of the annuity.

What’s interesting is that, while I have seen thousands of products come and go since starting Wink, Inc., there have been so few “original” ideas when it comes to annuity product development! Here, someone would interject, “What about GLWBs?”

Yeah, we stole that from the variable annuity business.

And yet another objection: “How about the long-term care benefits some annuities offer?”

Hey, genius, that came from the long-term care industry!

But there ARE some original ideas out there. Remember: I do not endorse any company or product, nor does my third-party market research firm, Wink. Given that, I want to bring to your attention an annuity feature that definitely caught my eye as being innovative.

I know you are proud that Legacy Marketing Group® was the first company to develop an annuity that carries a distinct account value charge, which allowed Legacy to offer participation rates and caps that are relatively more competitive than comparable products. That isn’t what caught my eye though. It was the “True Up” feature on the Americo LibertyMarksm series that made me do a double-take. I have never seen anything like it before in any annuity I’ve analyzed. When educating others, I explain that the LibertyMarksm Series True Up ensures that the account value charge on these products does not reduce the account value of the policy by an amount that is greater than the interest credited on the contract. I specify that after Year 5, the True Up retroactively credits back any charges that exceed the policy’s gain.

Refreshing! A consumer-friendly feature that protects the client’s principal!

And innovative ... a great solution for overcoming objections that the charge on the contract may result in the client ultimately receiving less than the funds paid into the annuity. Bravo!

I just wanted to let the two of you know that it is nice to see something in your product that is truly innovative and protects the client. In a period where I am seeing trends lean away from being “pro consumer,” it is nice to see something very different.

You caught my eye, Legacy Marketing Group®! I am definitely going to be watching for your next innovation.

Sheryl Moore is President and CEO of Moore Market Intelligence, an indexed product resource in Des Moines, Iowa, as well as the life and annuity market research firm of Wink, Inc. Her companies provide competitive intelligence, market research, product development, consulting services and insight to select financial services companies. She may be reached at sjm@indexedrockstar.com.

|

Many Americans are feeling regret over the way they handled their retirement planning—and the numbers are even greater for women—according to a recent survey by Global Atlantic Financial Group. Of all the respondents surveyed, 62% of women had regrets compared with 47% of men. Consequently, more women than men are adjusting their retirement lifestyle, making cuts to entertainment (51% vs. 42%) and travel (42% vs 34%).

Rather than take a “one-size-fits-all” approach to the retirement planning needs of women, financial advisors could provide more value by focusing on solutions to the distinct financial issues women face heading into retirement, such as underfunding their own retirement savings to care for a child or elderly parent, or to pay for a child’s education.

Amanda Schiavo, “Why Do Women ‘Torpedo’ Their Retirement Plans?” Financial Planning (December 18, 2018).

|

Helping Clients Leave More Despite Taking RMDs

On qualified funds, the IRS requires plan owners to begin taking Required Minimum Distributions (RMDs) by April 1 following the year they reach age 70 ½. But RMDs and other withdrawals can be a real concern for clients who are focused on leaving a financial legacy to loved ones.

What if you could offer clients a way to leave more money to their beneficiaries, despite taking RMDs?

According to Richard Middleton,* insurance professional, FlexMark Selectsm fixed index annuities from Ameritas Life Insurance Corp. can help clients turn RMDs into a financial legacy. That’s because the competitive rates and caps available with FlexMark Selectsm can provide greater earnings opportunity than is available with many products. So even after clients have taken withdrawals, they still have the potential to leave a tangible Accumulation Value to their beneficiaries.

According to Middleton, annuities that lack strong caps and participation rates, especially upon renewal, can have an Accumulation Value that cannot keep up with withdrawals taken. Once an Accumulation Value draws down to zero, there is no remaining death benefit available for beneficiaries. But because of FlexMark Selectsm’s strong earnings potential, clients may reduce the risk of drawing down their Accumulation Value as fast, allowing them to leave more money to loved ones.

Consider this example:** A hypothetical 70-year-old male purchases FlexMark Selectsm with the MyFit Income Ridersm† with $200,000 of qualified funds. His goal is to take RMDs without reducing the legacy he wants to leave his family. After Year 1, he begins taking rider withdrawals, which are increased to the RMD amount associated with the contract, if greater.

How long could this client take withdrawals from his annuity and still have the potential to leave a death benefit equal to his original premium? Possibly until age 89! With competitive earnings potential that outpaces withdrawals, his Accumulation Value at age 89 could hypothetically reach $201,954—more than his original premium, even after taking more than $260,000 in withdrawals. And his Accumulation Value doesn’t reach $0 until well past age 100, ensuring there’s always a death benefit available for his family. How many FIAs can say that?

To compare customized numbers, run a FlexMark Selectsm illustration today!

In approved states, FlexMark Selectsm Index Annuities (Form 2705) and riders are issued by Ameritas Life Insurance Corp. (Ameritas) located at 5900 O Street, Lincoln, NE 68510. Products are designed in conjunction with Ameritas and exclusively marketed by Legacy Marketing Group®. Ameritas and Legacy Marketing Group® are separate, independent entities. FlexMark Selectsm Index annuities are single premium deferred annuities that offer a fixed interest option and index interest options. The index options are not securities. Keep in mind, your clients are not participating in the market or investing in any stock or bond. Policies, index strategies, and riders may vary and may not be available in all states. Optional features and riders may have limitations, restrictions, and additional charges. Product guarantees are based on the claims-paying ability of Ameritas Life Insurance Corp. Refer to brochures for additional details. FlexMark Selectsm and MyFit Income Ridersm are service marks of Legacy Marketing Group®. Unless otherwise specified, any person or entity referenced herein is not an affiliate of Ameritas Life Insurance Corp. or any of its affiliates.

Withdrawals may be subject to income tax. If withdrawals are made before age 59½, they also may be subject to an IRS penalty tax. Ameritas, Legacy Marketing Group®, and their authorized representatives do not give legal or tax advice. It is recommended that tax advisers be consulted.

| * | Middleton, affiliated with National Brokers Alliance, was not compensated for this endorsement. |

| ** | Click here to view full illustration. The hypothetical example is used for illustrative purposes only. It is not reflective of actual annuity performance and does not guarantee future results. Actual results may vary. |

| † | Available for an annual charge of 0.95% for the MyFit Income Ridersm and 1.05% for the MyFit Income Ridersm With Booster (not available in all states). Income riders are not available on certain tax-qualified plan types. |

|

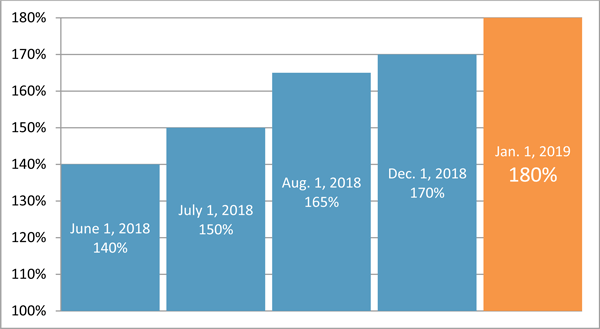

Rates Are UP, UP, UP, and UP Again

For the fourth time since June, participation rates have increased on the BNP Paribas Momentum Multi-Asset 5 Index* Two-Year Point-to-Point strategy on FlexMark Selectsm fixed index annuities from Ameritas Life Insurance Corp.

FlexMark Selectsm Upgraded Band Participation Rate

BNPP Momentum 5* Two-Year Point-to-Point With Fee**

Rates are subject to change at any time.

What could clients get with a 180% participation rate? Find out by running an illustration today.

Click to view all the competitive FlexMark Selectsm rates.

In approved states, FlexMark Selectsm Index Annuities (Form 2705) and riders are issued by Ameritas Life Insurance Corp. (Ameritas), located at 5900 O Street, Lincoln, NE 68510. Products are designed in conjunction with Ameritas and exclusively marketed by Legacy Marketing Group®. Ameritas and Legacy Marketing Group® are separate, independent entities. FlexMark Selectsm Index Annuities are single premium deferred annuities that offer a fixed interest option and index interest options. The index options are not securities. Keep in mind, your clients are not participating in the market or investing in any stock or bond. Policies, index strategies, and riders may vary and may not be available in all states. Optional features and riders may have limitations, restrictions, and additional charges. Product guarantees are based on the claims-paying ability of Ameritas Life Insurance Corp. Refer to brochures for additional details. FlexMark Selectsm is a service mark of Legacy Marketing Group®.

This product is not sponsored, endorsed, sold or promoted by BNP Paribas or any of its affiliates (collectively, “BNP Paribas”). Neither BNP Paribas nor any other party (including without limitation any calculation agents or data providers) makes any representation or warranty, express or implied, regarding the advisability of purchasing this product. BNP Paribas Momentum Multi-Asset 5 Index (the “Index”) is the exclusive property of BNP Paribas. BNP Paribas and the Index are service marks of BNP Paribas and are licensed for use for certain purposes by Ameritas Life Insurance Corp. BNP Paribas shall not have any liability with respect to the product. Neither BNP Paribas nor any other party has or will have any obligation or liability to owners of this product in connection with the administration or marketing of this product, and neither BNP Paribas nor any other party guarantees the accuracy and/or the completeness of the Index or any data included therein.

| * | The BNP Paribas Momentum Multi-Asset 5 Index (BNPP Momentum 5 Index) has limited historical information. The BNPP Momentum 5 Index is a new index strategy, launched on 1/27/ 2017. For more information about the BNPP Momentum 5 Index, visit https://momentum5index.bnpparibas.com. |

| ** | Fee and multi-year strategies not available in all states. |

|

|

The FlexMark Selectsm fixed index annuity MyFit Income Ridersm is “fitter” than ever—with a new 7% roll-up rate and payout factor increases. Now you can earn a Fitbit Altatm fitness wristband and get fit with it! Your challenge? Simply sell three applications for FlexMark Selectsm with the MyFit Income Ridersm or MyFit Income Ridersm With Booster from December 1, 2018, through February 28, 2019. You can do it! Your clients will thank you—your doctor will too! |

|

Americo Update Addresses Ad Approvals, eApps, and More

Be sure to read the recent Compliance Update from Americo Financial Life and Annuity Insurance Company, which reminds Producers about:

- Advertisement approvals.

- eApplication signatures.

- Increased California licensing fees.

- Expense allocation methodology used by Americo.

- Guaranteed Minimum Value Interest Rates for 2019.

Click here to view the complete Compliance Update. Have questions? Call our Customer Service and Suitability Help Desk at 800-395-1053, Ext. 5819, or e-mail SuitabilityHelpDesk@legacynet.com.

|

Share Your Funny Sales Story

Helping clients save for retirement is serious business. But sometimes we need a good laugh. Do you have a sales story that’s too funny not to share? Submit it to onthemark@legacynet.com in 200 words or less. The best story (in the opinion of our Sales Team) will be featured in our next issue, and the Producer who submitted it will receive a Fitbit Altatm fitness wristband!

|

Presidents Day Office Closure

In observance of Presidents Day, Legacy and Americo Financial Life and Annuity Insurance Company offices will be closed Monday, February 18 (Ameritas Life Insurance Corp. offices will be open). If you have immediate needs during that day, be sure to check LegacyNet® for all your business resources!

|